A Growing Market for iPhone, Branded Apps in Brazil

In Brazil, a country with a population of 190 million, there were 173.9 million mobile phones by the end of 2009 -- that means 9 out of 10 people have one. While Brazil is only the world’s 10th largest economy, it has a higher cell phone penetration rate than that of the United States.

While pre-paid phones dominate the market--82.55% of the market, vs 17.45% post-paid--the iPhone has become an object of desire in Brazil and is increasingly in popularity. It's also changing mobile behavior. Of the total number of mobile web hits in Brazil in February, almost half of them were made by the Apple phones, according to a recent survey.

The most awaited phone of recent times, the iPhone draws the attention of Brazilian consumers primarily because of the media player and web browsing. While those features are common in most modern cell phones, the difference is in how they work. Songs, pictures and videos are accessed through an interface similar to the iPod, one of the most popular players in the world and in Brazil. The web access interface is similar to that of computers, so it's a more robust experience for users. For the Brazilian advertiser Tomas Prado Felicio, who bought his iPhone in November 2010 through the Claro carrier, the number of applications available, the touch screen, the built-in iPod and web access through a larger screen are the main qualities of the device.

There isn’t an official survey tracing the iPhone's Brazilian user profile so far. But in an informal consultation with some executives from operators Vivo, Claro and TIM, we learned that the majority are likely male-- about 70% --aged 20 to 40 that love technology and make more than USD $30,000 per year.

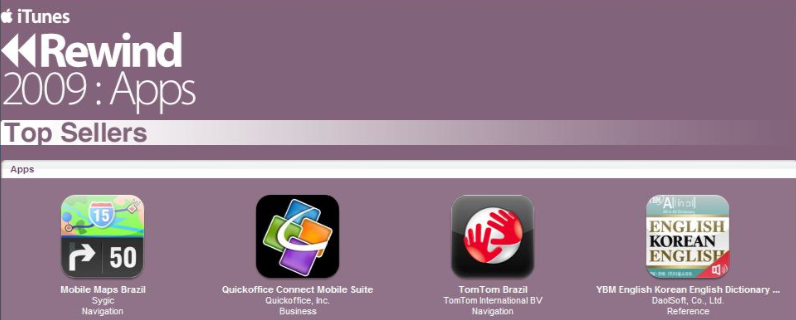

According to a list released by Apple, the top three apps in the Brazilian App Store last year are all utility-focused. The most downloaded was Sygic Mobile Brazil, the first turn-by-turn GPS to come with domestic maps. The office document editor was Quickoffice Mobile, which publishes and creates Word and Excel documents directly on the iPhone. Not surprisingly, eight of the apps on the list are mobile games, which many people play during pockets of down time.

As a result advertisers of this growing popularity, advertisers in the Brazilian market are investing in creating iPhone applications.

Centauro, a large network of sporting goods stores in Brazil, created an app with customized running tips as part of its customer acquisition strategy. The company hired Marcos Paulo Reis, a famous Brazilian Triathlon coach, to provide the tips, and the app has turned out to be a great branding tool for the company.

The Brazilian subsidiary of Pizza Hut also launched an iPhone application that demonstrates how a well-designed campaign can generate significant revenue. It offers a video game in addition to an order function. This app allows users to build and place their orders, choosing from many choices of pizzas, pasta and chicken wings. The user can choose the size of the dish, add ingredients through a drag and drop function and even shake the iPhone in order to add seasoning to the order. Using the locator function of the iPhone, the app automatically sends the order to the nearest store. In only three months, the application was responsible for over one million dollars in sales. McDonald's in Brazil has followed suit with their own iPhone app.

There is an obvious hunger for this new technology that will grow the market in coming years.

More than one year before being officially launched and available for sale in Brazil, iPhones already accounted for half of the mobile internet traffic in the networks of Brazilian mobile carriers. Now Brazilian consumers can buy an iPhone--unlocked or subsidized, with a contract--from any of the four major carriers that operate in the country. But prices can be steep: A 32GB iPhone 3GS can cost upwards of $1,500 Brazilian Real (USD $885), and an unlimited voice and data plan will cost roughly $270 per month or USD $150. To be fair, monthly plans and cell phone handsets tend to be much more expensive in Brazil than in the U.S. because of heavy government taxation. Consumers choosing other smartphones will likely only find the same pricey options for unlimited voice and data.

But despite this price barrier, the iPhone market will surely grow. In addition to the better user experience it provides and the growing number of applications, there is an economic incentive. Since it is possible to provide content to be accessed for offline, without an Internet connection, data traffic can be less expensive. Mobile broadband is also becoming more popular in Brazil, and prices will become increasingly more accessible.

This article was contributed by Edvaldo Acir, who does Business Development for FOX Latin American Channels in Brazil, and Andre Bodowski, a Brazilian-American Marketing Manager who lives in New York and São Paulo.